Auto Enrolment

Workplace pensions are undergoing a revolution. Automatic enrolment has not only changed the UK pensions landscape, it has also placed new obligations and costs on employers.

If you run a business with one or more employees, auto-enrolment will affect you and you should be aware of these changes. So what do you need to do?

Under the new legislation, every employee will be entitled to save into a qualifying workplace pension. As their employer, you will be responsible for organising a suitable scheme that meets certain key criteria.

How We Can Help

Here at BPU we have invested in the market leading software and training to help you through the auto enrolment process.

We can:

- Help you pull together all the necessary information

- Advise on any impact of decisions made

- Assess your workforce at each pay date

- Assist in selecting a compliant pension

- Handle all calculations

- Produce the specific file for the pension provider

- Issue all statutory communications

- Deal with all opt outs/ins

- Handle your annual compliance

- Register your firm with The Pensions Regulator

As it’s important to allow plenty of time to prepare for auto enrolment, we will be holding seminars to give you all the help and advice you need as your staging date approaches.

However, we can't do it all for you, so you should be making plans at least 6 months prior to your staging date, as there are many employer decisions to be made, training and points to action.

You can find out your company’s staging date by entering your PAYE reference into the staging date tool on the Pensions Regulator’s website at http://www.thepensionsregulator.gov.uk/. There are financial penalties for non compliance.

If you're currently running your own payroll system, auto enrolment will mean added training and new software to get your head around; BPU runs over 80 payrolls on behalf of our clients. We have the experience, the systems and the software to deal with all your payroll needs.

Whether you are an existing BPU client or not, please contact us if you have any questions on auto-enrolment or would like to know more about how we can assist you and your employees.

Please contact Andrew Miller 02920 734100 / andrewm@bpuaccountants.co.uk

The Pensions Regulator Checklist

Click to download a handy checklist from The Pensions Regulator to help you keep track throughout the Auto Enrolment Process.

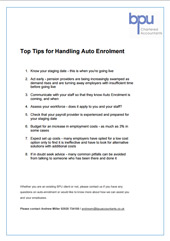

Download our Top Tips for Handling Auto Enrolment